-

011 477 0416 -

082 320 2424 -

info@taxassist.co.za -

Mon-Fri 09:00 - 16:00

1.1 Introduction: Why Your Tax Residency Matters More Than Your Passport.

For South Africans planning a permanent move abroad, a common and critical misunderstanding is that changing one's physical location or even acquiring foreign citizenship automatically changes one's tax obligations to the South African Revenue Service (SARS). This is incorrect. South Africa's tax system is "residency-based," not citizenship-based. This means your tax liability is determined by your official tax residency status, not the passport you hold.

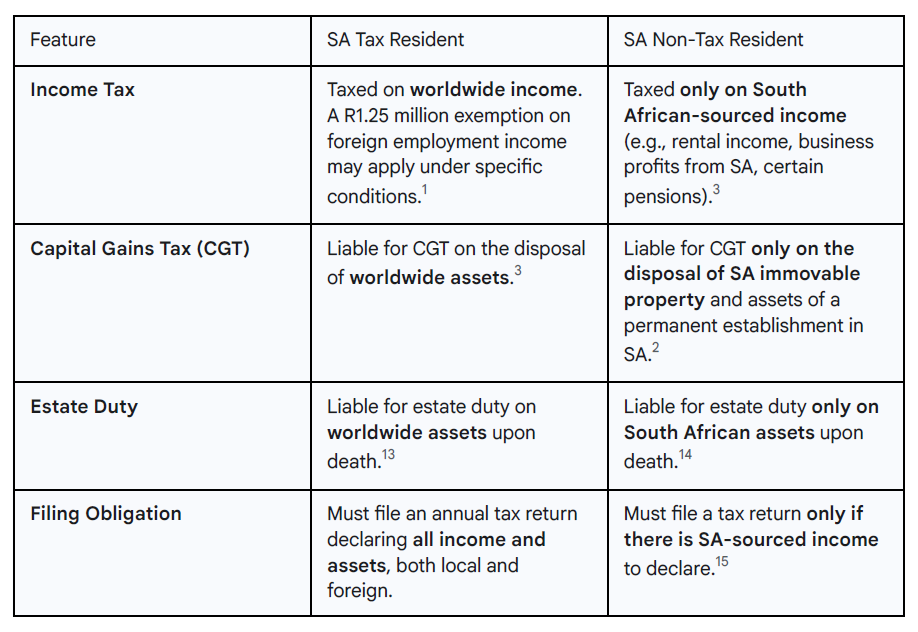

A South African tax resident is liable for tax on their worldwide income and is subject to Capital Gains Tax (CGT) on the disposal of their worldwide assets. In contrast, a non-resident is only taxed on income from a South African source (for example, rental income from a property in South Africa) and on capital gains from the disposal of South African immovable property.

Therefore, for any individual leaving South Africa permanently, formally ceasing tax residency with SARS is not an optional administrative step; it is a fundamental and non-negotiable requirement to align their tax obligations with their new life abroad and prevent potential double taxation or unforeseen liabilities on foreign earnings.

1.2 The Two Pillars of SA Tax Residency: Are You "Ordinarily Resident" or Just "Physically Present"?

SARS uses two primary tests, applied sequentially, to determine if an individual is a tax resident. An individual only needs to meet one of these tests to be considered a resident.

The Ordinarily Resident Test

This is the primary and most important test. It is a subjective test that seeks to determine the country that an individual considers

their "real home" or the place to which they would naturally return from their "wanderings". Because this test is

based on intention, SARS looks for objective, real-world factors to verify that intention. To cease being ordinarily resident, an

individual must demonstrate a clear intention to leave South Africa permanently, supported by tangible actions.

Factors that SARS will scrutinise include:

● The location of immediate family, particularly a spouse and minor children.

● The location of a primary home and most valuable personal belongings.

● The location of primary business, investment, and economic interests.

● Social connections, such as memberships in religious institutions, recreational clubs, or gyms.

Simply leaving the country is insufficient. An individual must actively and demonstrably move their "centre of vital interests" to their new home country.

The Physical Presence Test

This test is purely objective and is based on a simple day-counting formula. It is only applied if it has been established that an

individual is not ordinarily resident in South Africa. A person will be considered a tax resident under this test if they are physically

present in South Africa for periods exceeding:

● 91 days in the current tax year; AND

● 91 days in each of the five preceding tax years; AND

● 915 days in total during those five preceding tax years.

An individual must meet all three of these requirements to be deemed a resident under this test. Failing even one means they are not a resident by this measure. Furthermore, an individual who meets the physical presence test criteria will cease to be a resident from the day they leave South Africa if they remain outside the country for a continuous period of at least 330 full days.

1.3 Key Differences: A Tale of Two Taxpayers (Resident vs. Non-Resident)

Formally changing your status from resident to non-resident has a profound impact on your tax obligations. The table below provides a clear comparison of the key differences, illustrating the tangible benefits of undertaking the formal tax emigration process.

Table 1: Tax Obligations at a Glance (Resident vs. Non-Resident)

1.4 Myth Busting: Separating Fact from Fiction in Tax Emigration

The process of leaving South Africa is surrounded by persistent and often costly myths. It is vital to distinguish fact from fiction.

● Myth 1: Tax emigration happens automatically when I leave the country.

○ Reality: This is false. Ceasing tax residency is not automatic. It requires a formal, proactive declaration to SARS, supported by a

comprehensive file of evidence. Without this formal process, SARS will continue to regard you as a tax resident.

● Myth 2: I will lose my South African citizenship or have to give up my passport.

○ Reality: Tax emigration has no impact on your citizenship, your right to hold a South African passport, or your right to vote. It is

purely a change in your status for tax purposes.

● Myth 3: Once I am a non-resident, I can never return to South Africa, even for a holiday.

○ Reality: You can visit South Africa for holidays or business. However, your travel patterns will be monitored. Spending excessive time

in the country (typically more than 91 days per year) could lead to SARS reassessing your status and potentially re-triggering your tax

residency.

● Myth 4: I must sell all my South African assets, like my house and investments.

○ Reality: You are not required to sell your South African assets. You can retain property, investments, and bank accounts. However, any

income generated from these assets (e.g., rent, dividends) will be subject to South African tax under the rules applicable to

non-residents.

● Myth 5: As a non-resident, I will never have to file a tax return in South Africa again.

○ Reality: If you continue to earn any income from a South African source, you are legally required to file a non-resident tax return

with SARS each year to declare that income.

You can contact TaxAssist via many avenues, all of which are displayed on our Contact page.