-

011 477 0416 -

082 320 2424 -

info@taxassist.co.za -

Mon-Fri 09:00 - 16:00

Xero for Advocates in Private Practice

At TaxAssist we utilise world class accounting software to ensure that you gain the most value from our engagement. We also strive to improve your tax position as much as possible, but this objective will however only be achieved with your help.

This document will outline how to make use of the systems we provide, which documents need to provided, and your responsibilities in so far as tax compliance is concerned.

Xero Accounting Software

Xero is a market leader in accounting software development globally. TaxAssist is a Certified Xero Partner, and we encourage all clients to make use of this system.

You will find that it is an easy, effective and professional way to invoice your clients, generate statements, and gain better insight into your business’ performance.

There are a lot of tutorials available on the various functions of, and use of Xero. We can provide this content at your request, and assist as a certified adviser also where necessary.

In this document we will give you the basic information required to start invoicing clients and generating statements immediately. We will also explain how to set up bank feeds (so that we may retrieve your bank statements for you) and basic reporting functions.

Getting Started

We will setup your profile for you, so you needn’t be concerned by all the “accounting stuff”. We will however require your assistance with certain things to get you going. We will need the following from you before we can set up your account:

Invoicing

It has never been this easy. Xero is extremely user friendly, and can help you to manage your clients better than ever before.

You will be able to issue two types of invoices to your clients, being:

Tax InvoicePro-forma Invoice

Not all clients will make use of Pro-forma Invoices, but it is a function that is available. Pro-forma Invoicing is useful for cases that you are currently working on, for which payment is not due yet. This can also be seen as a fee book of sorts. You can create, and update Pro-forma Invoices as you are working on a case. Pro-forma invoices can be converted directly to a Tax Invoice once payment becomes due. A Pro-forma Invoice is a kin to a Quote in Xero, and such amounts will therefore not aggregate to Taxable Income until such a time that it is converted into a Tax Invoice. It should be noted that ageing will not be applied to Pro-forma Invoices before they are converted, as payment is not yet due. That being said, you can still generate and send these documents to your clients for perusal / approval.

Tax Invoices relate to completed work where payment is due. Your practice has been set up to default to payment terms of 97 days as per the Bar rules, and it will be indicated as such on the Invoice. Xero will also track ageing on such invoices, and alert you (and your client if you prefer) when payment becomes due, or is overdue.

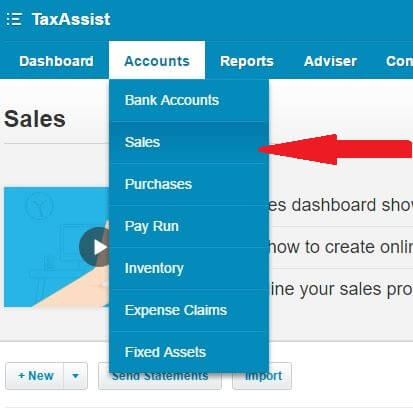

To generate an Invoice is simple. Once logged into Xero, select “Accounts” in the top taskbar menu, and then “Sales” in the drop down options:

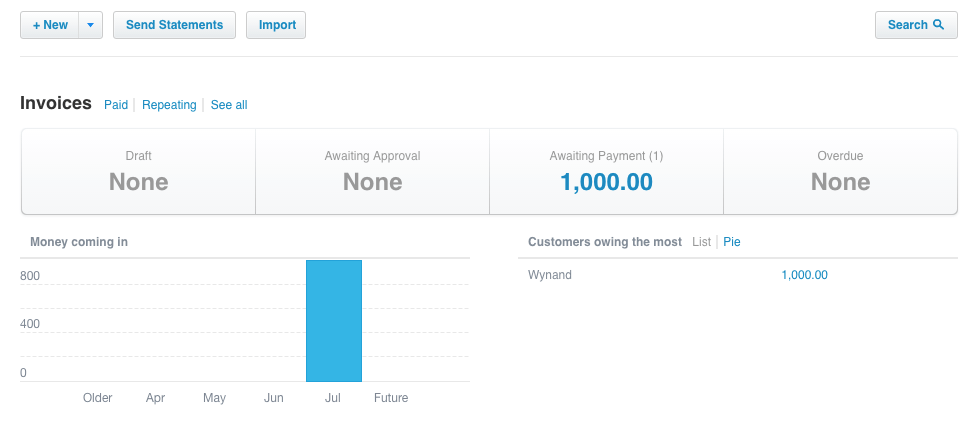

In the “Sales” menu you will see the following screen:

If you click on “New”, you will automatically start creating a new Tax Invoice. If rather want to create a Pro-forma Invoice, click on the

arrow next to “New” and select “Quote”. Don’t be concerned by the word “Quote” as the generated document will read “PROFORMA INVOICE”.

From the above screen you can also check which invoices have been drafted, issued and awaiting payment, overdue and much more. We encourage you to play around with these features and familiarise yourself with the layout and functionality.

Once you have selected “New” you will be presented with the following screen: